House depreciation calculator

Calculate the average annual percentage rate of appreciation. After calling BMT Tax Depreciation Michael found he could claim 15500 in depreciation deductions in the first full financial year.

Free Macrs Depreciation Calculator For Excel

Use a House Depreciation Calculator.

. It provides a couple different methods of depreciation. Depreciation recapture tax rates. Ad See your Propertys Market Value Free It Just Takes Seconds.

This calculation gives you the net return. First one can choose the straight line method of. It will take just a few minutes to enter the information.

There are many variables which can affect an items life expectancy that should be taken into. Percentage Declining Balance Depreciation Calculator. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

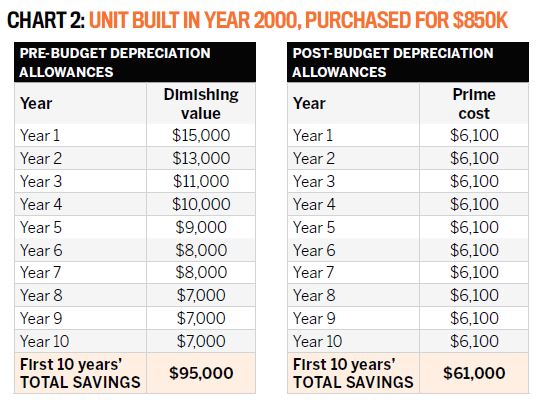

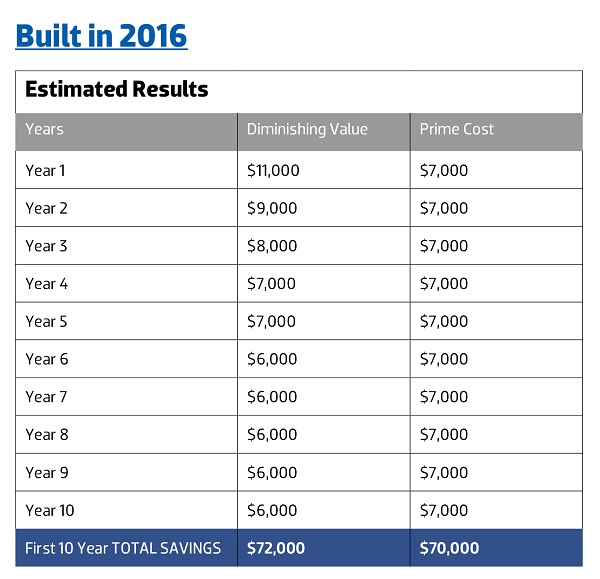

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. To be more specific you can exclude up to 250000 in capital gains when you sell your house. For example the Washington Brown calculator features each of the alternatives.

For example if you have. On the same date her property had an FMV of 180000 of which 15000 was for the land and 165000 was for the. The calculator allows you to.

House depreciation is a standard cost deduction process that is used effectively when making a purchase of any house. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to. House depreciation calculator India.

Divide the net return by the initial cost of the investment. Depreciation deduction for her home office in 2019 would be. Also includes a specialized real estate property calculator.

If you rent out your home you. A house was bought for 200000 in January 2014. Start by subtracting the initial value of the investment from the final value.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

A new house purchased for 730000. That means the total deprecation for house for year 2019 equals. 270000 x 1605 43335.

This can be extended to 500000 if you file a joint tax return with your spouse. In January 2019 it was valued at 250000. The calculator should be used as a general guide only.

This depreciation calculator is for calculating the depreciation schedule of an asset. Our FREE on-line Depreciation Calculator goes through the same process as we do when clients phone for depreciation estimates. Accelerated depreciation for qualified Indian reservation property.

Another option is to use a house depreciation calculator. A 250000 P 200000 n 5.

Depreciation Formula Calculate Depreciation Expense

How Depreciation Claiming Boosts Property Cash Flow

Depreciation Schedule Formula And Calculator Excel Template

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Rental Property Depreciation Rules Schedule Recapture

5 Complex Depreciation Rules Explained Yip

Appliance Depreciation Calculator

Bouquet Hang Medical Rental Depreciation Calculator Vorbamea Ro

Depreciation Of Building Definition Examples How To Calculate

A Guide To Property Depreciation And How Much You Can Save

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Appreciation Depreciation Calculator Salecalc Com

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

15 Most Important Real Estate Metrics For Investors